Saudi Arabia and the United Arab Emirates (UAE) are locked in a high-stakes race to be the main artificial intelligence (AI) tech hub in the Middle East.

They are spending — and attracting — veritable fortunes for their ambitions, forming strategic alliances with U.S. tech giants, and planning to build some of the world’s largest data center clusters.

Both countries are seeking to diversify their dependence on oil revenues, and they see AI as a driver of economic growth, according to the Gulf Studies Symposium.

Saudi Arabia’s Vision 2030 strategy names AI as essential to economic transformation, with 70% of its strategic goals involving data and AI, according to officials at the Saudi Data and AI Authority.

The UAE even appointed a minister of state for AI in 2017 and created an AI university, Mohamed bin Zayed University of Artificial Intelligence (MBZUAI). The university is now opening a Silicon Valley AI lab.

Early on, the UAE appeared to hold an edge with its proactive AI strategy and partnerships, but Saudi Arabia has roared back with major investments and state-backed initiatives.

Consider the following commitments in and by Saudi Arabia year-to-date in conjunction with President Trump’s visit in May.

- Humain, a state-backed AI company under its Public Investment Fund (PIF), is planning to launch a $10 billion venture capital fund.

- Google Cloud and PIF are investing $10 billion to jointly build and operate an AI hub in Saudi Arabia.

- AWS and Humain announced a joint $5 billion investment to build an “AI Zone” in the kingdom to grow demand for advanced AI services. This is in addition to the previously announced $5.3 billion to develop Saudi Arabia as a new AWS region.

- Oracle announced it was investing $14 billion in Saudi Arabia’s digital cloud and AI infrastructure over 10 years.

- Equinix is reportedly building a $1 billion data center to meet growing demand for cloud, AI and enterprise workloads.

UAE also has a slew of AI investments:

- It launched MGX, an investment firm focused on AI and backed by the state-owned Mubadala investment firm and AI development holding company G42. It aims to invest $100 billion in AI infrastructure, chips and core AI technologies. MGX is one of the investors in Stargate, OpenAI’s $500 million data center project.

- Stargate UAE is a proposed AI data center hub from OpenAI, G42, Oracle, Nvidia and SoftBank. It expects to build a 1 gigawatt data center cluster with 200 megawatts expected to go live in 2026.

- Abu Dhabi is investing $3.54 billion to automate all of its government processes through the Abu Dhabi Government Digital Strategy for 2025 to 2027.

The rivalry between Saudi Arabia and the UAE is unfolding against the backdrop of AI competition between the U.S. and China. Trump wants to ensure that countries in the Persian Gulf stay dependent on U.S. technology instead of pivoting to China. In a diplomatic gesture, Trump removed Biden’s chip restrictions on the region.

Read more: Saudi Arabia Unveils $10 Billion VC Fund in Race for Middle East’s AI Crown

New Proving Ground

AI supremacy requires compute — and that means big, energy-hungry data centers. Saudi Arabia and the UAE are racing to build them at scale.

As of early 2025, Saudi Arabia had existing data center capacity of more than 300 megawatts, which is competitive with UAE’s capacity of more than 250 megawatts, according to ResearchAndMarkets.com.

But when it comes to future projects, Saudi Arabia blows away the UAE: It has upcoming capacity of 2,200 megawatts while the UAE is expecting about 500 megawatts, research firm reported.

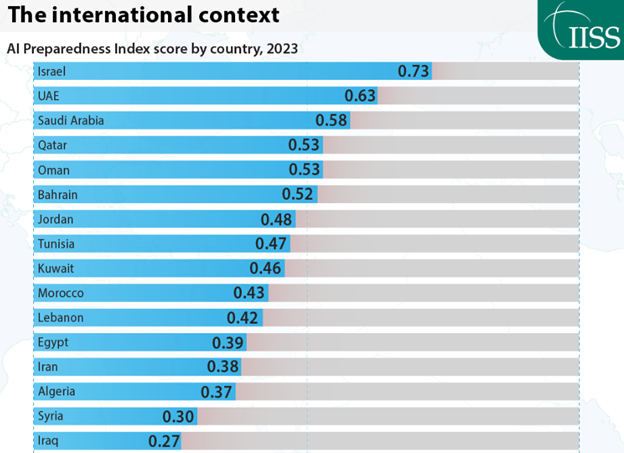

According to the International Institute of Strategic Studies (IISS), AI preparedness in the Middle East can vary by quite a lot. Israel leads the pack, followed by UAE and Saudi Arabia. After Qatar, Oman and Bahrain, the rest drop off considerably in the rankings.

But the ability of a country to harness the potential of AI depends in part on the availability of data centers, wrote Laith Alajlouni and Jasim Murad in an IISS blog post. “These play a critical role in satisfying AI’s vast computational and data-storage demands.”

The Mideast has two things data centers need: energy and money. “With about $5 trillion in sovereign wealth, the Gulf states have the financial means to become serious contenders in AI and data centers,” they wrote.

Despite the flow of capital and chips, both nations face major challenges. Neither has produced a frontier AI model on par with OpenAI’s GPT-4 or China’s DeepSeek. Skilled AI talent remains scarce, and while sovereign wealth and low energy costs offer advantages, building an innovation ecosystem will take time.

But what’s clear is that the AI race is no longer confined to Silicon Valley or Shenzhen. It is now just as likely to be shaped from Riyadh and Abu Dhabi.

Read more: Nvidia and Amazon Land Middle Eastern AI Deals Amid Trump Visit

Read more: Bahrain’s AI Push in Middle East Could Serve as Model for Region, Experts Say

Read more: AI Startups Find Financing Pipeline in Middle Eastern Sovereign Wealth Funds