The next installment in PYMNTS’ generational mini-series takes a deep dive into Generation Z’s digital habits and behavior.

Born between 1997 and 2012, Gen Z is the youngest generation that includes adult members and, for that reason, the youngest age cohort PYMNTS regularly studies. (PYMNTS’ data only analyzes adult consumers — those 18 years old and older.) This digital-native generation is the first to not have experienced life before the internet, leading to a characteristic adaptability when it comes to tech and payment innovations.

In some cases, they lead the push toward cutting-edge tools, while in others, they trail the more established and next closest generation, millennials. Highlighting findings from five of our key research themes — healthcare, finances, payment preferences, food and banking security — paints a broad picture of Gen Z’s place in the larger ConnectedEconomy™.

Healthcare: When it comes to making healthcare payments, Gen Z makes payments in person 32% of the time, roughly similar to other generations. However, 27% would prefer paying through a digital portal, making this option Gen Z’s top choice — and highlighting that some providers must catch up to meet these patients’ preferences. Eighty-eight percent of Gen Z pay for visits in full, while 10% set up a payment plan, slightly behind millennials’ 11%. Perhaps because of their reduced credit history, they are the least likely generation to use a credit card for healthcare transactions, with only 7% of Gen Z’ers surveyed opting to use the payment method. However, they are the age cohort most likely to use wearables, with 74% using at least one healthcare wearable device or connected app.

Payment Preferences: By and large, Gen Z is the most open to payment innovations among the generations PYMNTS tracks. Of those surveyed, 79% have tried a new payment method in the last year, the highest share across age demographics. Gen Z’s digital wallet adoption is roughly on par with other generations at 66%, but they are the most enthusiastic about mobile wallets’ potential, with 51% saying the innovation can mostly replace physical wallets. Gen Z’ers also trust mobile wallets the most compared to other generations, with 44% saying using a mobile wallet is just as safe as using a physical one.

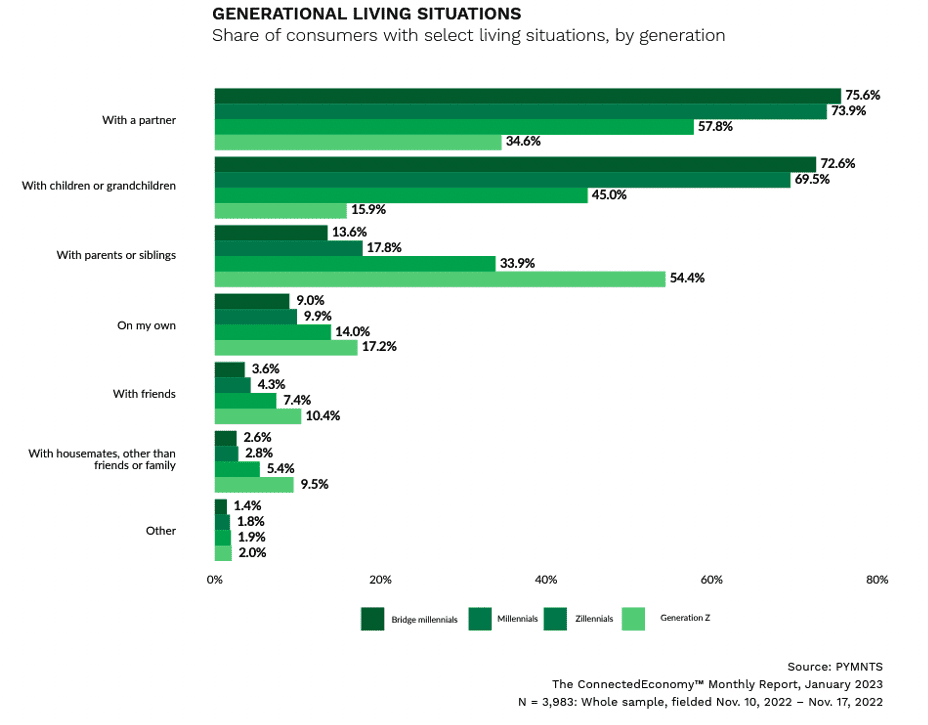

Finances: Of Gen Z’ers surveyed, 9% said they would not be able to afford a theoretical $400 expense. However, they are the generation whose ability to save during the year previous to being surveyed increased the most, at 43%. As noted in the PYMNTS’ January “Connected Economy™ Monthly Report,” this may partially be due to their general living situation, as 54% reside with a parent or sibling.

Food: Gen Z’ers, like those from other generations, have had to adjust their restaurant habits in the face of inflation, with 29% of those surveyed opting to eat out less often. Another 18% have dealt with rising menu prices by eating out at less expensive restaurants. Although 78% of Gen Z’ers left a tip at their last quick-service meal, 51% have decreased the amount they left. When it comes to grocery shopping, 21% have sacrificed both quantity and quality of food purchased to combat rising costs.

Banking Security: As with payment innovations, Gen Z is the age cohort most adaptable to innovation when it comes to banking and security. At 26% of those surveyed, their generation boasts the highest share of consumers banking digital-only, with 60% saying they would switch financial institutions (FI) for an improved mobile or digital experience. When asked about their view of their primary bank’s security features, 43% said they are comfortable with the current mix their FI provides.